Market Update

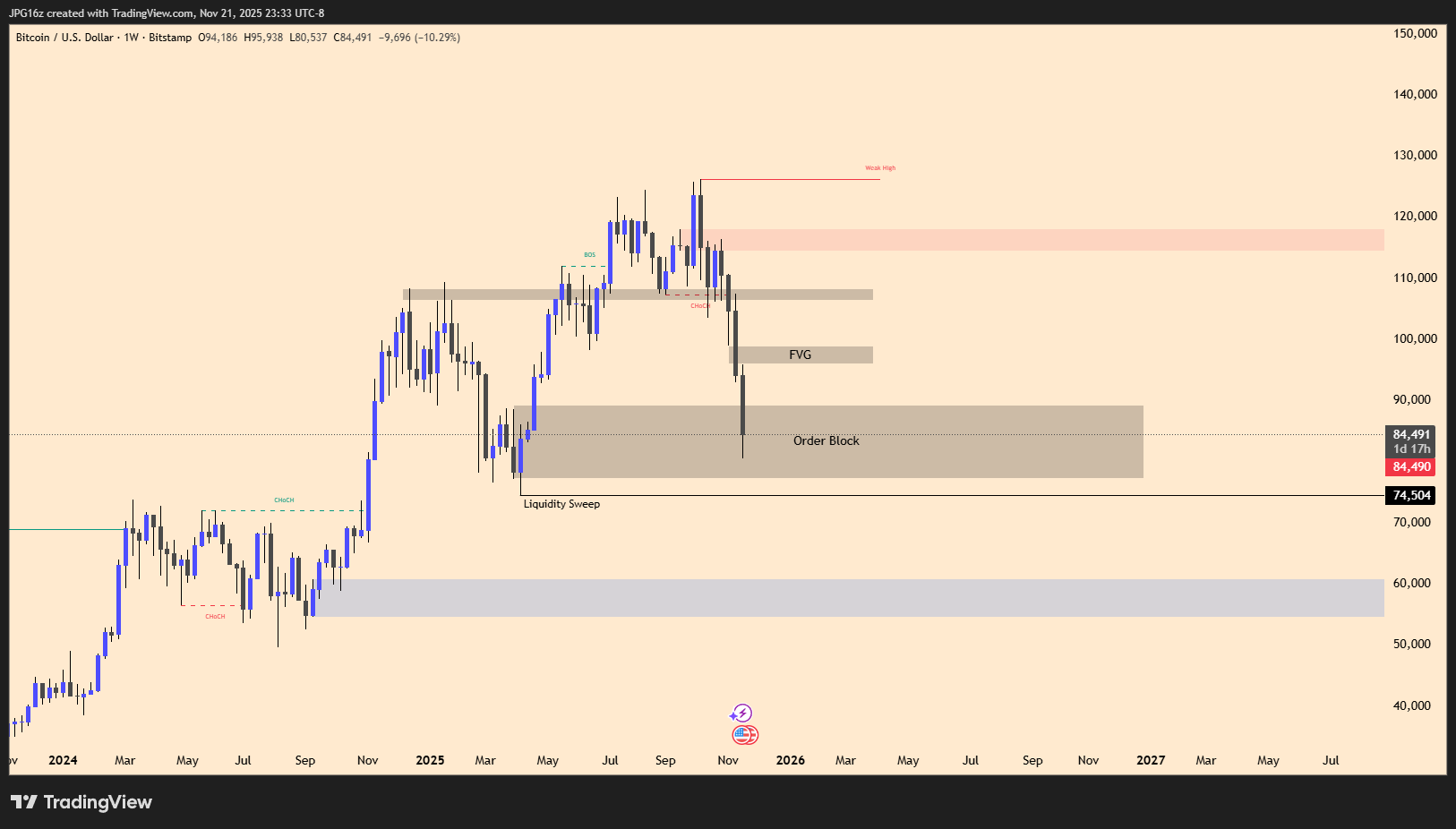

Market Outlook: Why More Downside May Still Be Ahead

Bitcoin appears to be in a free fall at the moment, and based on current market structure, I see a potential move down toward the $75K range. A sweep of liquidity in that zone paired with price tapping into a key bullish order block, could set the stage for a market bottom across BTC and other large-cap cryptocurrencies.

This could potentially create a bottom for Bitcoin to start slowly grinding higher which is ultimately good for Alt coins and the entire crypto market.

Why the Market Could Still Move Lower

1. Heightened Market Fear

Sentiment remains shaky. Traders are defensive, liquidity is thinning, and momentum has slowed conditions that often lead to retracements.

2. No Rate Cuts in Sight

With rate cuts delayed, risk-on assets like crypto are struggling to find confidence. Signs of a stronger dollar makes asset like Bitcoin unattractive.

3. Sell-Off in Equities

Both the S&P and NASDAQ have shown weakness. When stocks sell off, crypto typically follows as institutions reduce exposure across all risk assets.

4. Headlines and Uncertainty

Recent speculation—such as talk about Epstein being an early BTC funder—adds fuel to fear-driven narratives. Even if unconfirmed, stories like this can pressure markets already on edge.

Altcoins I’m Watching While the Market Is Down

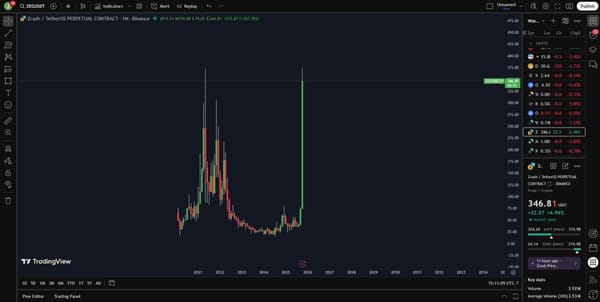

Zcash (ZEC)

Zcash remains the leader in the privacy sector. It has a fixed supply of 21 million, so it mirrors Bitcoin’s scarcity, but with one key difference: privacy. As technology, AI, and digital ID systems evolve, personal privacy becomes more valuable every day.

A major signal came when the Winklevoss twins invested $50 million dollars to acquire 5% of the entire Zcash supply through their treasury company, Cypherpunk Technologies. These are not casual buyers. They are early Bitcoin veterans known for their legal battle with Facebook, and their move hints that Zcash could be a strong early play for investors.

$Avici

Avici is a neobank designed to merge crypto and fiat in a way that puts full ownership back in the hands of the user. Everything operates on-chain, and no central bank or institution controls your funds. Anyone using Avici becomes their own bank.

You get full custody of your crypto while using it in the real world through a debit card tied directly to your digital wallet. This is a potential game changer for crypto usability, and Avici is positioning itself at the front of that shift.

Early hints of private wallet support from the developer. If that becomes reality, the upside could be massive.

Virtual

Virtual is becoming a leader in crypto AI and on-chain innovation. Powered by the Virtual Protocol, the platform lets anyone create autonomous AI agents on-chain with no coding required.

Picture this:

You or any builder can create a custom AI agent in minutes. It could be a 24/7 streamer, a trading bot, a gaming bot, a content creator, or anything else you imagine. Each agent even gets its own token.

Virtual aligns with every major narrative in crypto right now. It is building tools that have real-world potential, especially in the AI and robotics sector.